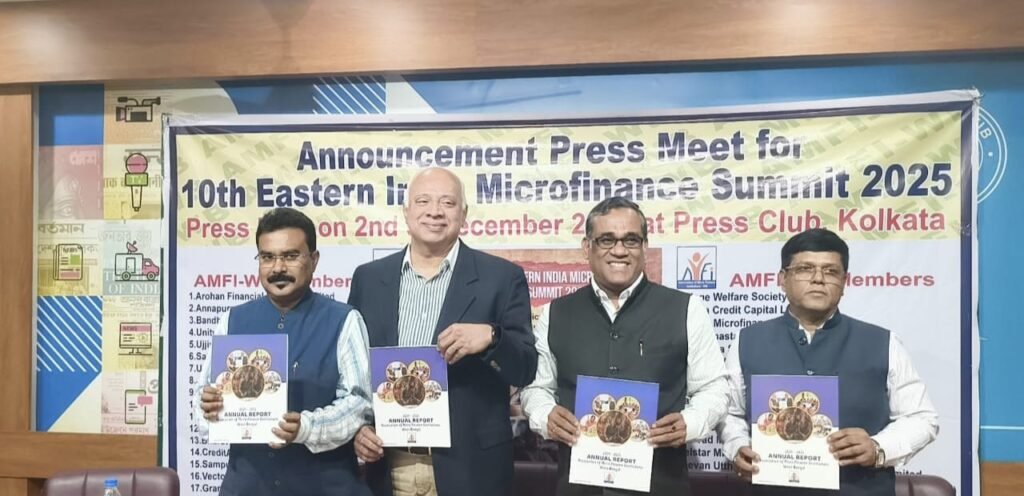

Kolkata, 2nd December, 2025: The Association of Microfinance Institutions – West Bengal (AMFI-WB) will be organizing the 10th Edition of Eastern India Microfinance Summit 2025 in association with MFIN and Sa-Dhan, and supported by Equifax as Knowledge Partner and M2i as Research Partner. This year the theme of the Summit is Reimagining Microfinance towards Viksit Bharat. The 10th Eastern India Microfinance Summit 2025 will be held on 10th of December 2025 at Dhono Dhanyo Auditorium, Alipore, in Kolkata.

India has set for itself an ambitious and transformative vision of becoming a developed nation by 2047—Viksit Bharat. Central to this aspiration is inclusive growth that reaches every household, especially low-income families and women borrowers. Microfinance plays a pivotal role in bridging this gap by ensuring equitable access to financial services for communities often excluded from mainstream finance.

However, the past year and a half have tested the microfinance sector with repayment challenges, concerns around over-indebtedness, and pandemic aftershocks. Despite these pressures, the sector has demonstrated remarkable adaptability—strengthening guardrails, reinforcing responsible practices, and aligning more closely with evolving regulations of the Government of India and the Reserve Bank of India.

The theme of this year’s summit — “Reimagining Microfinance towards Viksit Bharat” — centres around three interconnected pillars that collectively shape the future trajectory of the microfinance sector. Recovery remains a critical priority as institutions continue to rebound from the disruptions of COVID-19, workforce attrition, and portfolio stress. The sector is steadily regaining momentum by rebuilding stronger operational systems, enhancing staff capacity, and re-establishing confidence within borrower communities. Equally vital is the pillar of Protecting Borrowers, which reinforces the foundational responsibility of microfinance to safeguard client welfare. Strengthened compliance frameworks, greater transparency, and robust client protection mechanisms are ensuring that credit is extended in a responsible and ethical manner, thereby minimizing the risks of over-indebtedness and ensuring that financial support genuinely improves household resilience. The third pillar, Inspiring Investor Confidence, underscores the indispensable role of funders in sustaining sectoral stability and growth. With clearer regulatory guidance, stronger governance practices, and improved institutional resilience, the microfinance sector continues to demonstrate its credibility and long-term viability, positioning itself as a dependable and attractive segment within the financial services industry.

The 10th Eastern India Microfinance Summit 2025 provides an important platform for collaboration among MFIs, banks, fintechs, investors, regulators, and civil society to shape a resilient, people-centric microfinance ecosystem aligned with India’s development goals.