Kolkata, 4th July 2025 : Motilal Oswal Asset Management Company (MOAMC), India’s dedicated equity-focused fund house, announced the launch of its integrated brand campaign titled “The Growth Managers” — a strategic initiative that showcases its dedicated approach to building high-quality, growth-oriented equity portfolios for Indian investors.

As India’s mutual fund industry continues its steep growth trajectory with assets under management (AUM) surging from about ₹15 lakh crore to over ₹72 lakh crore in the last decade, Motilal Oswal AMC has carved out a differentiated space by staying exclusively focused on equities. The AMC has leveraged its decades of equity research and disciplined investment philosophy to deliver long-term outcomes for investors.

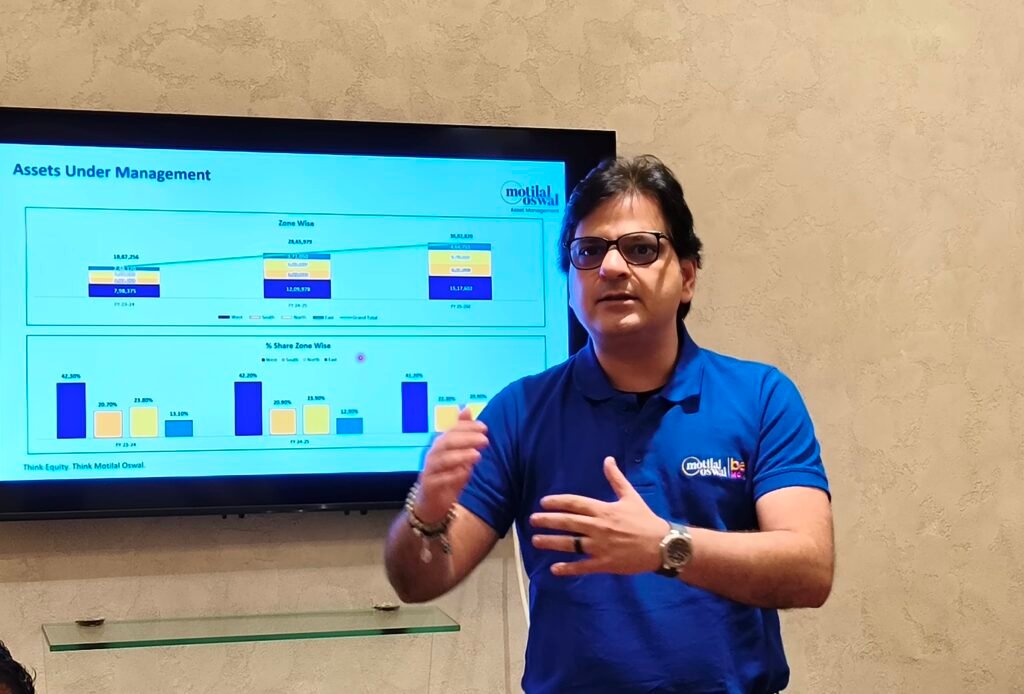

While the mutual fund industry witnessed a 36% rise in folios over the past year, Motilal Oswal AMC grew exponentially, with a 218% increase, nearly seven times the industry growth rate. This surge reflects a rising investor preference for focused, research-backed, equity-driven solutions.

Reflecting the increasing investor participation in focused equity strategies, West Bengal has emerged as a key contributor to this momentum. According to an internal AMFI-based analysis by MOAMC, the state saw nearly a 28 % year-on-year rise in average AUM in May 2025, with equity-oriented schemes alone accounting for 63% of the total assets. This steady increase indicates that more investors—across geographies—are considering equity-led diversification, reinforcing MOAMC’s investment philosophy in high-quality, high-growth investing.

At the heart of the brand campaign lies a core belief:

“High Quality. High Growth — Benefit from Both.”

This philosophy drives MOAMC’s approach of identifying businesses with consistent earnings, strong leadership, and sound valuations, while maintaining prudent risk management. The result is a suite of portfolios built with care, conviction, and clarity.

The product campaign highlights three flagship funds: Motilal Oswal Large & Midcap Fund for a blend of established and emerging companies, Motilal Oswal Multicap Fund for balanced diversification across market caps and Motilal Oswal Flexi Cap Fund for dynamic, opportunity-driven investing without cap constraints.

Launching today, the six-week campaign will span digital media, print, and influencer-led storytelling. The objective is to build deeper awareness around MOAMC’s differentiated offerings and encourage informed, long-term investing among retail and HNI audiences.

Prateek Agrawal, MD & CEO, Motilal Oswal Asset Management Company, added:

“As an equity-focussed AMC, our commitment has always been to deliver thoughtfully constructed portfolios built on rigorous research. Our belief is that markets follow sustained earnings growth and portfolios built with high quality and sustained growth in earnings focus can aim for better outcomes over a period of time.

India offers several young high-growth spaces which enables the same. High growth focus results in aportfolio construct which is very different from benchmarks and hence mayhave differentiated outcomes vs the index. We believe our positioning and portfolio construct would appeal to long term investors. While markets can be volatile, our message is clear: High-quality high sustained growth investing aims to support favourable long-term outcomes. Our campaign is about celebrating that philosophy and the trust that increasing number of investors are placing in us.”

Akhil Chaturvedi, CBO & ED, Motilal Oswal Asset Management Company (MOAMC) said,“The consistent year-on-year increase in West Bengal’s mutual fund AAUM, especially the rise in equity-focused schemes, reflects the state’s evolving investment landscape. It is encouraging to see more investors exploring equity as part of their portfolio diversification.”

“Looking ahead to FY26, we intend to explore opportunities to launch new funds across both active and passive categories to meet evolving investor needs”, he added.